A small number has a large impact

The topic is the guaranteed interest rate for life insurance and annuities.

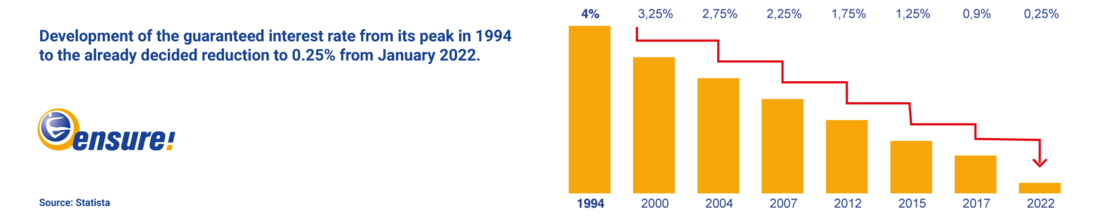

From January 1st, 2022, insurers may only promise a maximum annual interest rate of 0.25 percent for new contracts. This affects new contracts for life insurance, Riester and Rürup pensions, and company pension plans. This means that "riestern", "rüruppen" and other old-age provisions are hardly worthwhile. If you also consider that even in the past, with relatively high guaranteed interest rates, only the savings balance (payments minus commissions and fees) earned interest.

- Legislator lowers the guaranteed interest rate as of 2022/01/01

- If you take out a pension plan by November 30th, you can secure the higher guaranteed interest rate and pay 20 percent less for the same coverage than after the reduction.

Legislation has stipulated that the guaranteed interest rate will be reduced from 0.9 to just 0.25 percent from January 1st, 2022. Since July 1994, the guaranteed interest rate for pension products has therefore fallen continuously. In the good old days, the guaranteed interest rate was still 4 percent.

We will explain to you what this means for insurance policies and how you can secure the guaranteed interest rate. For example, you can save around 20 percent on an annuity insurance policy if you take it out this year (by November 30th, 2021).

Important to know:

Not only pension insurance is affected, but also term life insurance and occupational disability insurance.

What is the effect of the reduction in the guaranteed interest rate?

For all those who already have pension coverage: the reduction in the guaranteed interest rate does not affect existing contracts! The guaranteed interest rate that was valid at the time the contract was concluded always applies. That is why it is called the guaranteed interest rate.

The guaranteed interest rate is used to pay interest on the savings contribution to the pension insurance – the savings contribution is the amount you have paid in minus all the costs incurred by the insurance company for sales, administration and risk protection. The guaranteed interest rate also affects the amount of the payouts at the start of the pension.

It's better to make provisions than to be down the drain later!

There are numerous ways to provide for later. It is important to recognize early on the responsibility that each of us has. Ideally, retirement provision is based on three equally strong pillars: statutory pension insurance, occupational pension provision and private pension provision.

If, for example, the statutory pension scheme threatens to collapse, it is important to restore the balance by strengthening the other areas.

This is the only way to ensure that the standard of living can be maintained in retirement.